Investment

A Practical Guide to Direct Indexing for Customized ESG and Tax-Harvesting Goals

Let’s be honest. For a long time, investing felt a bit like ordering from a fixed menu. You could pick the large-cap fund, the tech ETF, or the sustainable mutual fund. But what if you wanted to leave out just one ingredient you didn’t like? Or swap a side dish for something better for you? That’s the core promise of direct indexing—it hands you the recipe book and lets you cook for yourself. And today,…

Building a Resilient Portfolio with Climate-Resilient Infrastructure Funds

Let’s be honest. The weather feels… different. More intense. And for investors, that’s not just small talk—it’s a fundamental shift in risk. You know, the kind of shift that makes you look at your portfolio and wonder if it’s built for the world we actually live in, not the one we remember. That’s where the idea of climate-resilient infrastructure funds comes in. Think of them not just as an ESG trend, but as a pragmatic,…

Navigating Frontier Market Investments in Africa and Southeast Asia: Demographics, Mobile Finance, and Local Partnerships

Let’s be honest. For a long time, the words “frontier market” sent a shiver down the spine of the average investor. Visions of red tape, political risk, and opaque markets. But here’s the deal: the narrative has flipped. Today, Africa and Southeast Asia aren’t just emerging—they’re leapfrogging. And for those with the right map, the potential is staggering. We’re talking about economies bypassing traditional development stages, going straight from no banking to mobile wallets, from…

Passive Income Through Fractional Ownership: Your Slice of Art, Collectibles, and Ideas

Let’s be honest. The idea of passive income is magnetic. Money that flows in while you sleep, travel, or simply live your life. But for most of us, the classic paths—rental properties, dividend stocks—feel either out of reach or, well, a bit boring. What if your portfolio could include a piece of a Banksy painting, a vintage Ferrari, or even the royalties from a hit song? That’s the promise—and the new reality—of generating passive income…

Investing in Space Technology: Your Guide to the Final Frontier of Finance

Look up. That starry expanse isn’t just for dreaming anymore. It’s becoming the next great marketplace. Investing in space technology and commercial space ventures has rocketed from science fiction to a tangible, and honestly, explosive asset class. We’re not talking about a distant future. This is happening right now. Private companies are launching satellites, resupplying the International Space Station, and even planning for orbital hotels. The question for many investors is no longer “if” but…

Finance

Let’s be honest. The world of investing can feel cold. A spreadsheet of numbers. A distant ticker symbol. But what if your money could do more? What if it could align with your values and still aim for solid returns? That’s the heart of ethical and sustainable investing. It’s not just a niche trend anymore; it’s a powerful shift in how individual retail investors—people like you and me—are choosing to build their futures. You know,…

Stock Market

Let’s be honest. The idea of early retirement sounds incredible, but the path to get there? It can feel like staring at a mountain you’re supposed to climb without a map. The FIRE (Financial Independence, Retire Early) movement offers a blueprint, but the actual building materials—your investments—are what truly matter. For many, a dividend growth portfolio isn’t just a pile of stocks. It’s an income-generating engine, one you build brick by brick while you’re still…

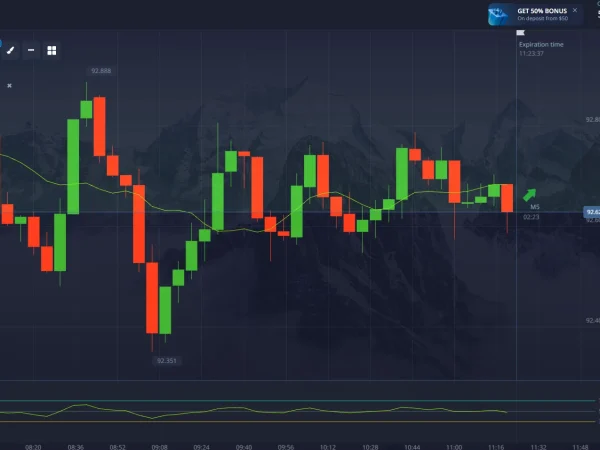

Forex

Let’s be honest. The world of forex trading is noisy. It’s a 24-hour storm of economic reports, geopolitical tweets, and price charts that seem to have a mind of their own. For years, traders have chased the holy grail: a reliable, personalized signal that cuts through the chaos. Well, that chase is changing. Dramatically. Enter AI and machine learning. This isn’t just about faster calculations anymore. It’s about creating a trading companion that learns your…

Cryptocurrency

Real-World Asset Tokenization: A Game Changer for Small Businesses and Local Projects

Let’s be honest. For a local coffee shop, a community solar farm, or a neighborhood art gallery, the word “blockchain” probably feels like tech from another planet. It’s for crypto whales and Wall Street, right? Well, not anymore. There’s a quiet revolution brewing, and it’s called real-world asset (RWA) tokenization. And honestly, it might just be the tool your local economy has been waiting for. Here’s the deal in simple terms: tokenization is like taking…

Crypto for Digital Nomads: Navigating Taxes, Banking, and Income Across Borders

Let’s be honest. The digital nomad dream—working from a beach in Bali one month and a café in Lisbon the next—is incredible. Until you have to think about money. Traditional banking? A headache of international fees and blocked transfers. Taxes? A labyrinth of residency rules that makes your head spin. That’s where cryptocurrency enters the scene. It’s not just an investment; for many location-independent workers, it’s becoming a practical toolkit. But here’s the deal: using…

Cryptocurrency for Digital Nomads and International Remote Workers: Your New Financial Passport

Let’s be honest. The digital nomad life looks incredible on Instagram. But behind the laptop-on-the-beach photos is a tangled web of financial headaches. Bank fees that nibble away at your income like piranhas. Exchange rates that seem to shift against you, personally. And that sinking feeling when a cross-border payment gets stuck in bureaucratic limbo for a week. What if there was a way to carry your entire financial life in your pocket, independent of…

How Quantum Computing Could Disrupt Blockchain Security

You’ve heard the hype. Quantum computing is this… well, almost mythical next frontier in processing power. It promises to solve problems in minutes that would take today’s supercomputers millennia. It sounds like science fiction, right? But here’s the thing. This emerging tech casts a long shadow over another digital titan: blockchain. The very foundation of Bitcoin, Ethereum, and the entire decentralized web. The security we take for granted in these systems—the one that protects trillions…

The Rise of Crypto Gaming and Play-to-Earn Economies

Remember trading Pokémon cards in the schoolyard? The thrill of the hunt, the strategy of the trade, and that undeniable feeling that your Charizard was… well, an actual asset. Crypto gaming has taken that childhood feeling and blasted it into the stratosphere with blockchain technology. It’s not just about play anymore. It’s about earning real value for your time and skill. We’re witnessing a fundamental shift. Video games are evolving from closed ecosystems into open,…