Let’s be honest—DeFi can feel like the Wild West. One day you’re riding high on yield farming gains, the next you’re staring at a smart contract hack draining millions. But here’s the deal: when done right, investing in DeFi protocols can be wildly rewarding. You just need the right strategies. What Exactly Is DeFi (And Why Should You Care)? DeFi—short for decentralized finance—cuts out the middleman. No banks. No brokers. Just code running on blockchains…

"Investing in Decentralized Finance (DeFi) Protocols and Strategies: A No-Nonsense Guide"Category: Investment

Decentralized finance—DeFi for short—is like the Wild West of investing. No banks, no middlemen, just code and opportunity. But with great freedom comes, well, a steep learning curve. Let’s break down how to invest in DeFi protocols without getting rekt. What Is DeFi, Anyway? Imagine a financial system where everything—loans, trades, savings—runs on blockchain. No paperwork, no gatekeepers. That’s DeFi. It’s built on smart contracts (self-executing code) and operates 24/7. The catch? You’re your own…

"Investing in Decentralized Finance (DeFi) Protocols and Strategies"What going green means is to keep the natural environment healthy and there are enough natural resources for the next generations. Furthermore, it refers to not making any waste and not causing any pollution. Several studies have shown that companies are financially rewarded for making their business operations green: they can secure higher profit margins than their non-green counterparts. We come today to the final part, on how you can become more planet-friendly. There are,…

"Going Green – Investing in the Future With Renewable Energy"Millennials have faced many economic obstacles during their 20-something years, such as high student loan debt and a fluctuating stock market. Yet with time on their side and investing as an avenue towards reaching long-term financial goals, 20-somethings may be able to use investment to their advantage and meet long-term financial goals. Step one in creating your savings plan should be setting a goal that can be kept and gradually increased over time. 1. Invest…

"Investment Tips for Millennials: Building Wealth in Your 20s"There are various strategies available for investing in precious metals. Individual investors may purchase physical bullion such as coins or bars they store themselves or ETFs/mutual funds with portfolios containing precious metals or mining company stocks. Precious metals offer investors inflation protection and real-life insurance against financial or political/military upheaval, which makes them attractive investments for many people. But whether or not precious metals are right for your particular goals and circumstances is ultimately up…

"Investing in Precious Metals – Gold Silver and Beyond"Investing in mutual funds and exchange-traded funds (ETFs) has become a cornerstone of modern financial planning. Offering a blend of diversification, professional management, and ease of access, these investment vehicles are popular choices for both novice and seasoned investors. This article provides an in-depth look at the nuances of investing in mutual funds and ETFs, helping you make informed decisions in your investment journey. Understanding Mutual Funds A mutual fund is a professionally managed investment…

"Navigating the World of Mutual Funds and ETFs: A Comprehensive Guide"Inflation is a natural part of any economy and it can have a dramatic effect on your savings and investments. It occurs due to more money chasing fewer goods and services; thankfully there are ways you can combat inflation. Investments that outpace inflation rates may help protect purchasing power over time. When designing your financial plan, you should include inflation rates. Inflation is a natural part of the economy If your money doesn’t stretch as…

"The Impact of Inflation on Your Savings and Investments"Cryptocurrencies and blockchain technology offer an innovative solution to transactions without relying on centralized companies or third parties, so understanding their inner workings may prove helpful when applying to work in this sector. Blockchain networks use transparent and immutable mechanisms to store information securely. This data could include transactional records, votes in an election, product inventories, state identifications or deeds to real estate properties. Cryptocurrency Cryptocurrency is a form of digital money created and traded…

"How Cryptocurrencies and Blockchain Technology Work"Exchange-traded funds (ETFs) have revolutionised how investors access the financial markets. ETFs offer a versatile toolset for experienced traders in the Czech Republic to implement sophisticated trading strategies. This article provides seasoned traders with advanced techniques tailored to the Czech market to enhance their ETF trading proficiency. Advanced ETF selection: Fine-tuning your portfolio Experienced traders understand that not all ETFs are created equal. To maximise returns, it’s crucial to meticulously select ETFs that align with…

"Mastering ETF trading: Techniques for experienced traders in Czech"As defaults continue to rise, it’s important for lenders and creditors to understand their rights in bankruptcy court. If you are owed money from a borrower who filed for bankruptcy, contact Kahana & Feld LLP to discuss your legal options. Bankruptcy eliminates debt and stops foreclosures, repossessions, wage garnishment and debt collection activities. However, it can also cause problems for those who co-signed a loan. 1. Communicate With Your Lender When you fall behind on…

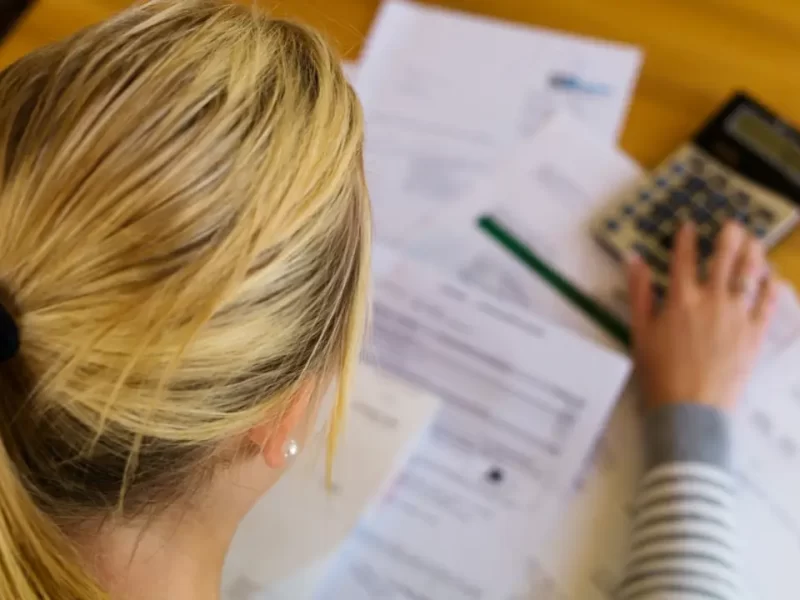

"Dealing With Loan Default and Bankruptcy Steps to Take"